Introduction

The year ahead should be approached with cautious optimism. Amidst economic uncertainty, employers have regained the upper hand in the job market — especially in industries where layoffs have resounded in recent years due to interest rate hikes — but it may be temporary. Despite higher-than-average pay increases in 2023 and planned for 2024, employees are dissatisfied and want more from their employment experiences. If the economy picks up and the job market rebounds, we could see another wave of intensified turnover, especially given shortages in skilled labor. In other words, the War for Talent isn’t over; it’s just on pause.

At the same time, the world is undergoing accelerated technological change. The opportunity to invest should not be missed, especially given the pressures on HR leaders to maximize spend. While artificial intelligence may be in a hype cycle, technology powered by some forms of AI has the potential to streamline workloads and transform HR. Technology is also increasing expectations for transparency and fairness, which are central to modern compensation management. To not risk falling behind, organizations need to invest in modern, purpose-built compensation technology to support best practices, optimize spend, and sow the seeds for competitive differentiation and future growth.

Labor challenges

The economy slowed in 2023 but did not go into a recession as anticipated. In fact, GDP growth in 2023 outpaced 2022. Nevertheless, more organizations reported not meeting or exceeding revenue goals in 2023 compared to the year prior.

In 2024, the U.S. economy is forecasted to be exceptionally sluggish. However, proposals to cut interest rates may boost economic growth, especially in the back half of the year.

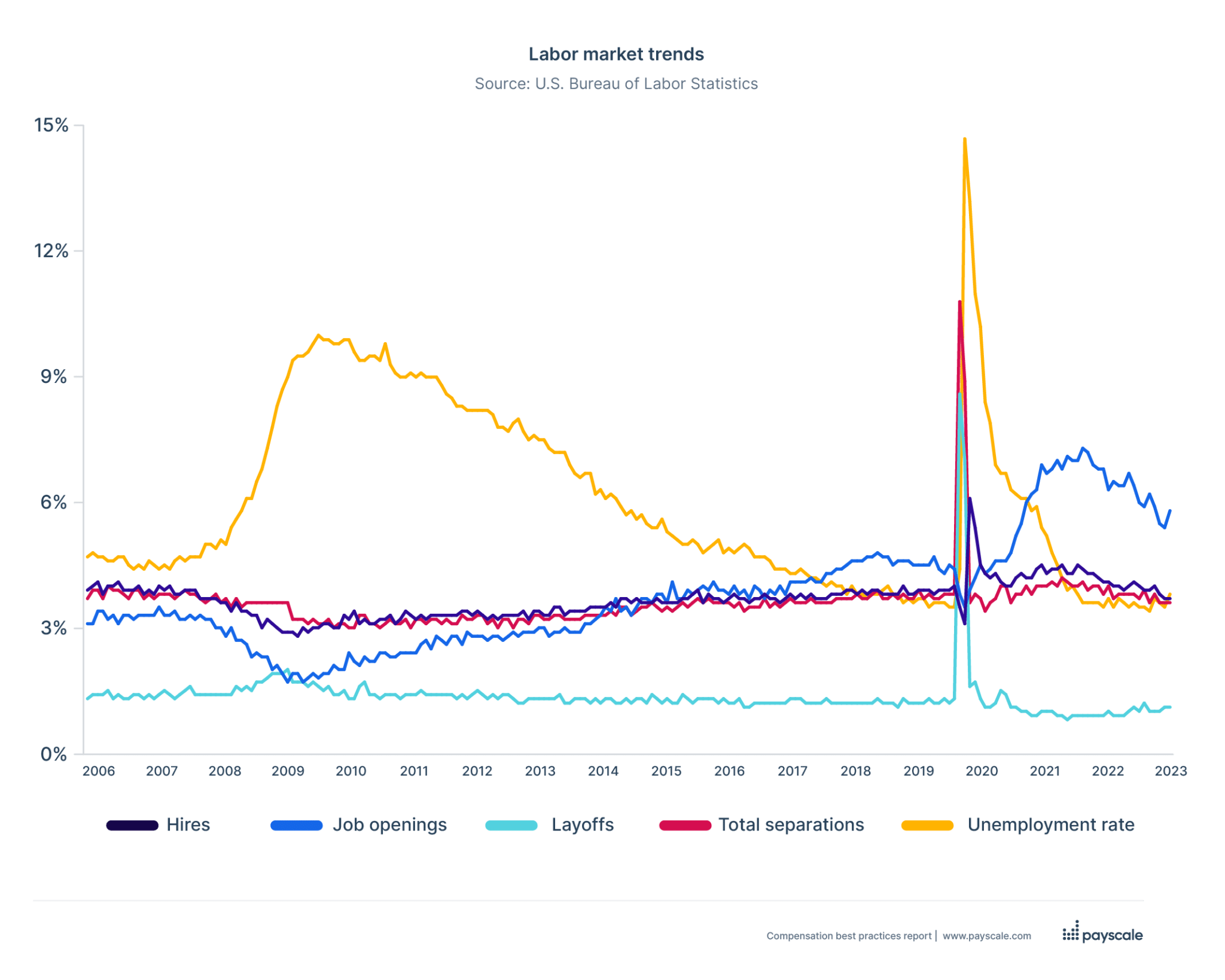

Unsurprisingly, the job market in 2023 frustrated employers and job candidates alike. Hiring slowed to pre-pandemic levels, but the spirit of the Great Resignation continued, leading to fierce competition amongst job candidates for too few open positions and hiring managers drowning in resumes. While employers have enjoyed getting some of their power back, the situation suggests that if the job market picks up, so will turnover.

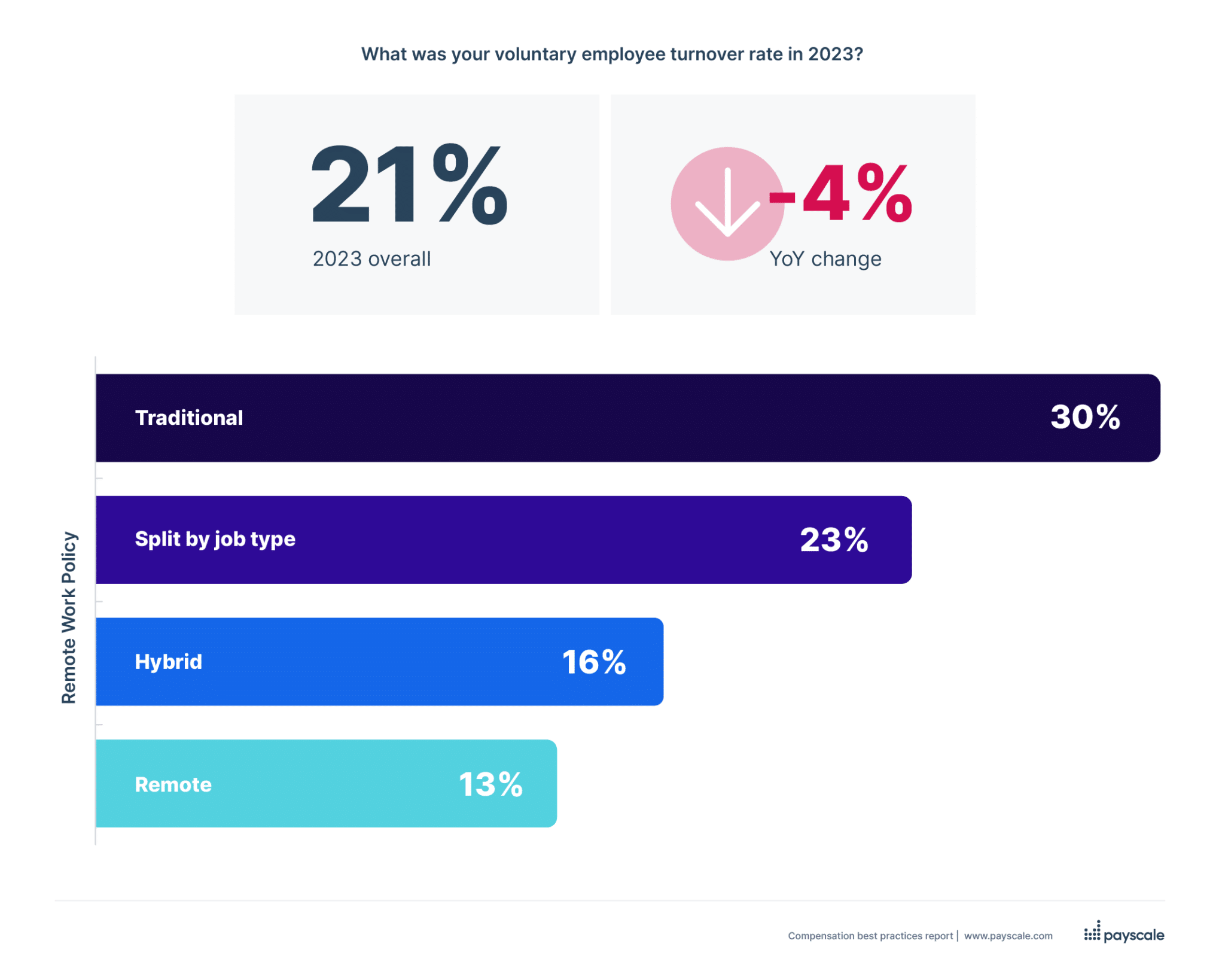

Voluntary turnover decreased in 2023 (21 percent) compared to 2022 (25 percent) and is much lower than 2021 (36 percent) — evidence that the Great Resignation has ended. However, it is worth emphasizing that workers are still expressing dissatisfaction with employment experiences, ranging from wages not keeping up with inflation to a lack of attention paid to mental well-being in the workplace. Dissatisfaction has been especially poignant in relation to hotly debated return-to-office mandates. Interestingly, turnover for organizations with remote work environments is much lower than for traditional offices and even hybrid office environments.

Pay increases

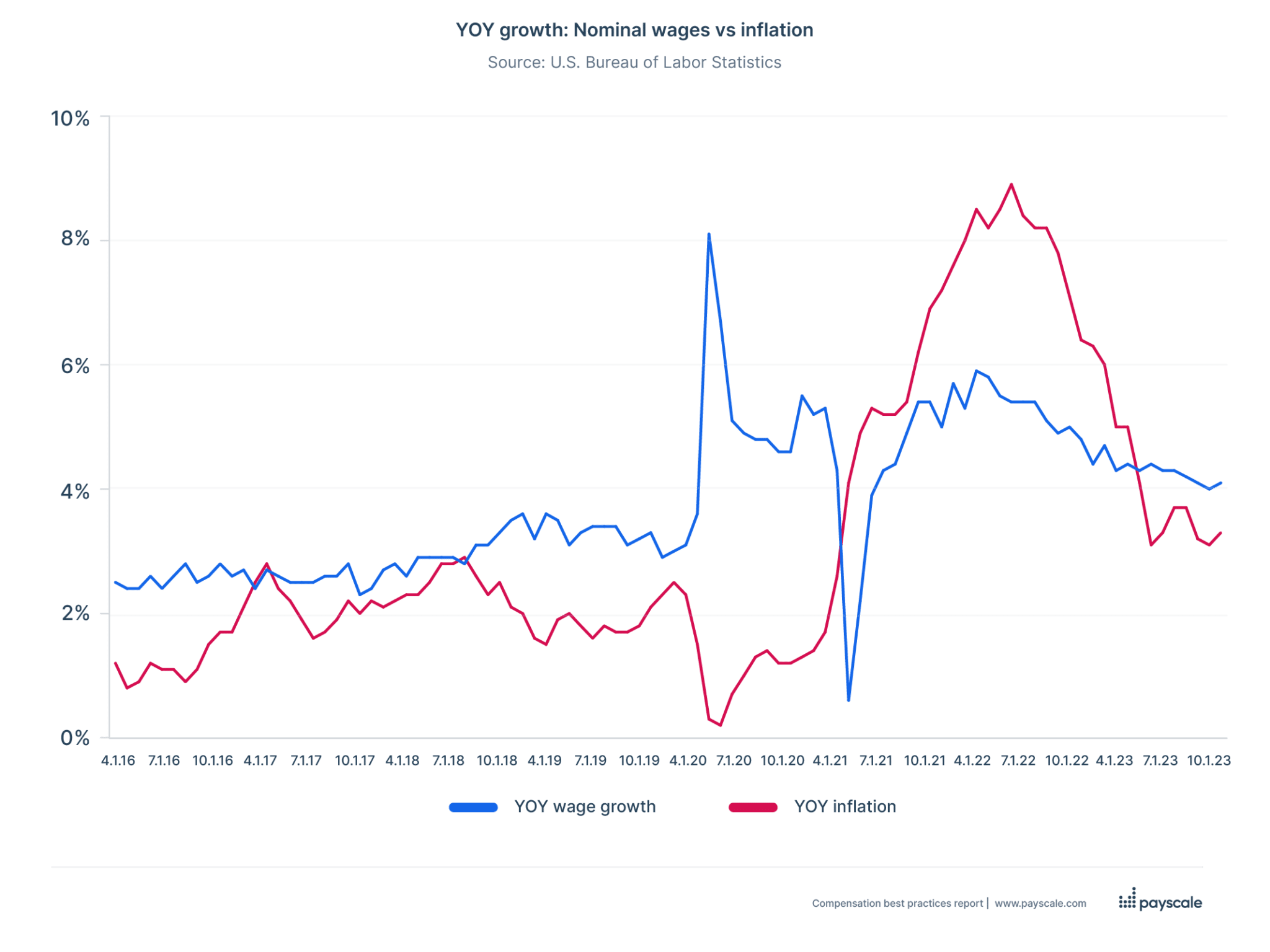

Against this economic backdrop, pay increases are a tough challenge for organizations. While lowering pay increases is common in a struggling economy, wages have lagged cost of living until recently. Inflation has thankfully come down, giving employers the opportunity to give pay raises above inflation in 2024. This is particularly important given that wage growth has also continued to be strong — especially for blue-collar workers, who have seen the highest wage growth.

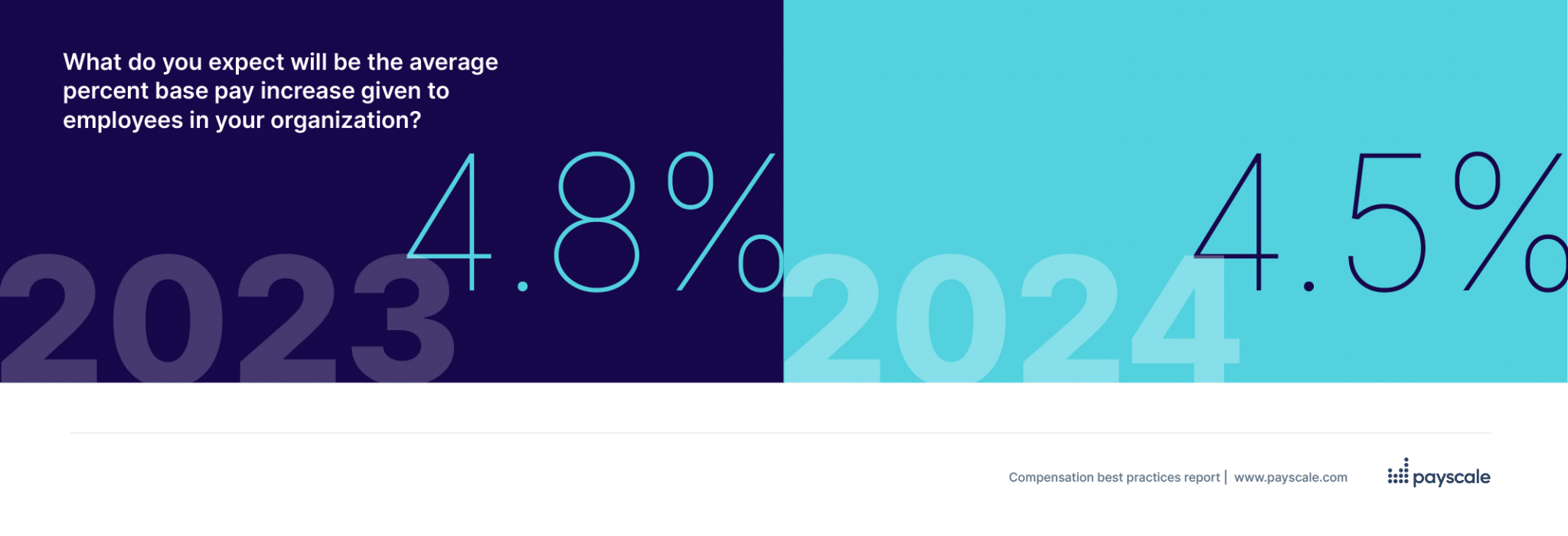

According to our survey, 2023 was the hallmark year for pay increases, with 4.8 percent being the average given across all organization sizes and industries — an amount that hasn’t been seen in decades. In 2024, employers are planning to give 4.5 percent pay increases on average.

In the interactive Tableau below, you can also look at pay increases by industry, company size, top performers vs. non top performers, and Canada vs. the United States for both 2023 and 2024. Larger pay increases are expected for top performers and smaller organizations.

Fair pay

While pay increases planned for 2024 are higher compared to before the pandemic, organizations need to be cognizant that pay may still be insufficient, especially if wages lag the market. While employees are less likely to jump ship in a slow job market where layoffs have reverberated over the past year, they are 50 percent more likely to do so if they believe they are underpaid.

Notably, over a quarter of organizations (27 percent) say they only address severely underpaid employees reactively, meaning that the employee or their manager has to ask. This is a problem seen equally across all organization sizes.

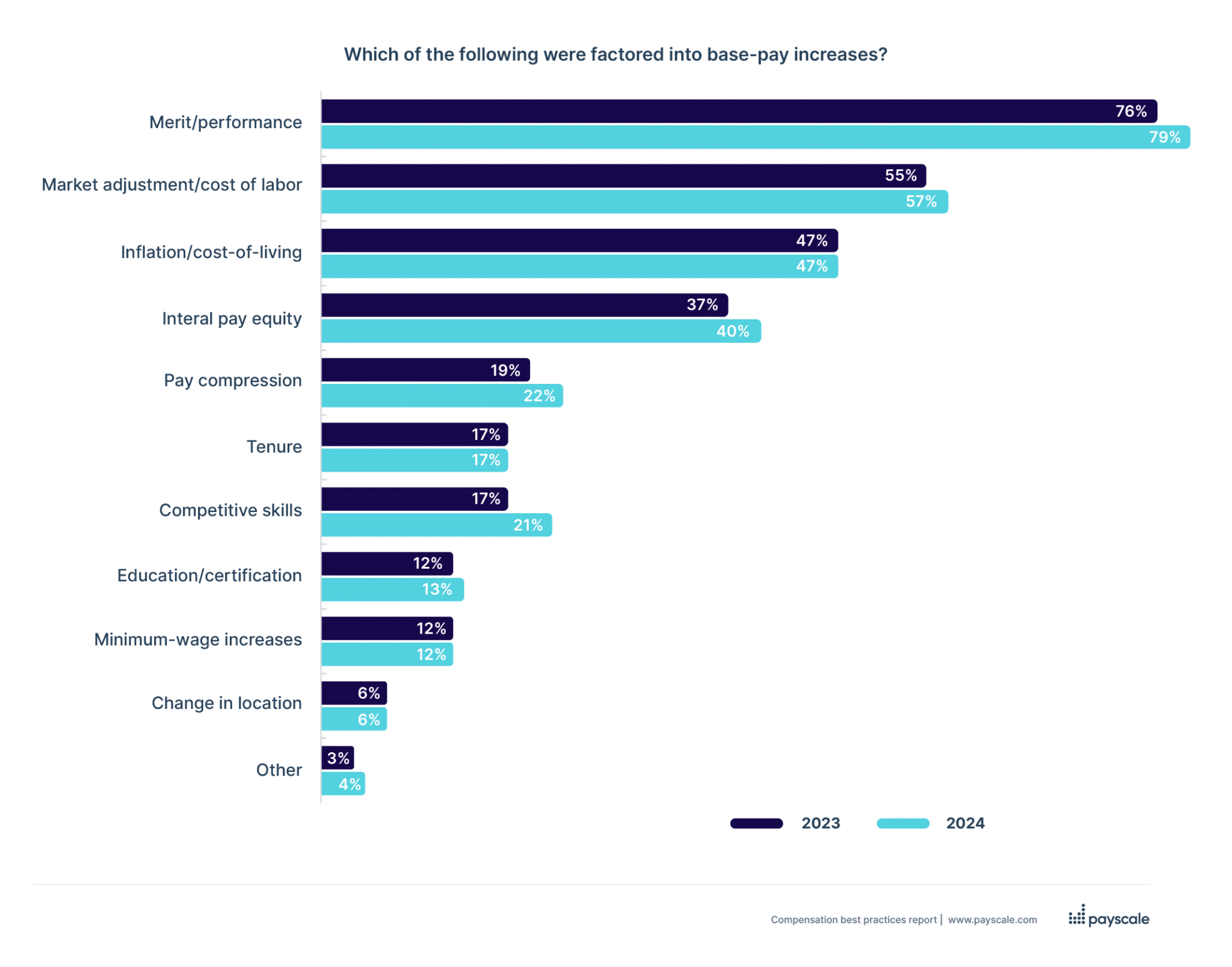

Fortunately, forward-thinking organizations are allocating spend to retain talent. Compared to last year, more organizations are rewarding merit/performance as well as making adjustments for external pay equity (cost of labor), pay compression, internal pay equity, and competitive skills.

Pay transparency

Fair pay is under greater scrutiny thanks to pay transparency legislation, which began to pick up steam in 2022 and is expected to continue to expand. In 2024, pay transparency has already become a compensation best practice, as a majority of organizations (60%) now say they publish salary ranges in job ads — up 15 percent over last year.

While one in four employees are currently impacted by pay transparency legally speaking, based on living in states where legislation has passed, a greater number are impacted when considering growing awareness and changes in behavior when it comes to applying for jobs.

While 52 percent of organizations say they haven’t heard anything from employees about pay transparency, 27 percent say that employees have been asking more questions about their pay, 14 percent say that they have experienced talent loss due to employees seeing postings with higher ranges elsewhere, and 11 percent say that employees have realized through job postings that they are underpaid.

To reap the benefits of pay transparency on talent acquisition, retention, and engagement, organizations need to invest in compensation strategy and equitable pay structures so they can have confidence in pay communications. Payscale salary data, compensation technology, and professional services can help organizations achieve these goals.

Pay communications

2024 is the first year we have technically seen a majority of organizations say that they train managers on pay communications (51 percent), but it’s still only half.

Increased confidence in pay communications is often the end goal of mature compensation practices. While publishing pay ranges to job advertisements satisfies compliance with pay transparency legislation, the real objective is to help employees understand both the “what” and “why” of how they are paid. To achieve this, organizations need to take a proactive approach to pay transparency that goes beyond compliance with the law.

Manager training on pay communications is more common for larger organizations but varies considerably by industry.

Compensation maturity

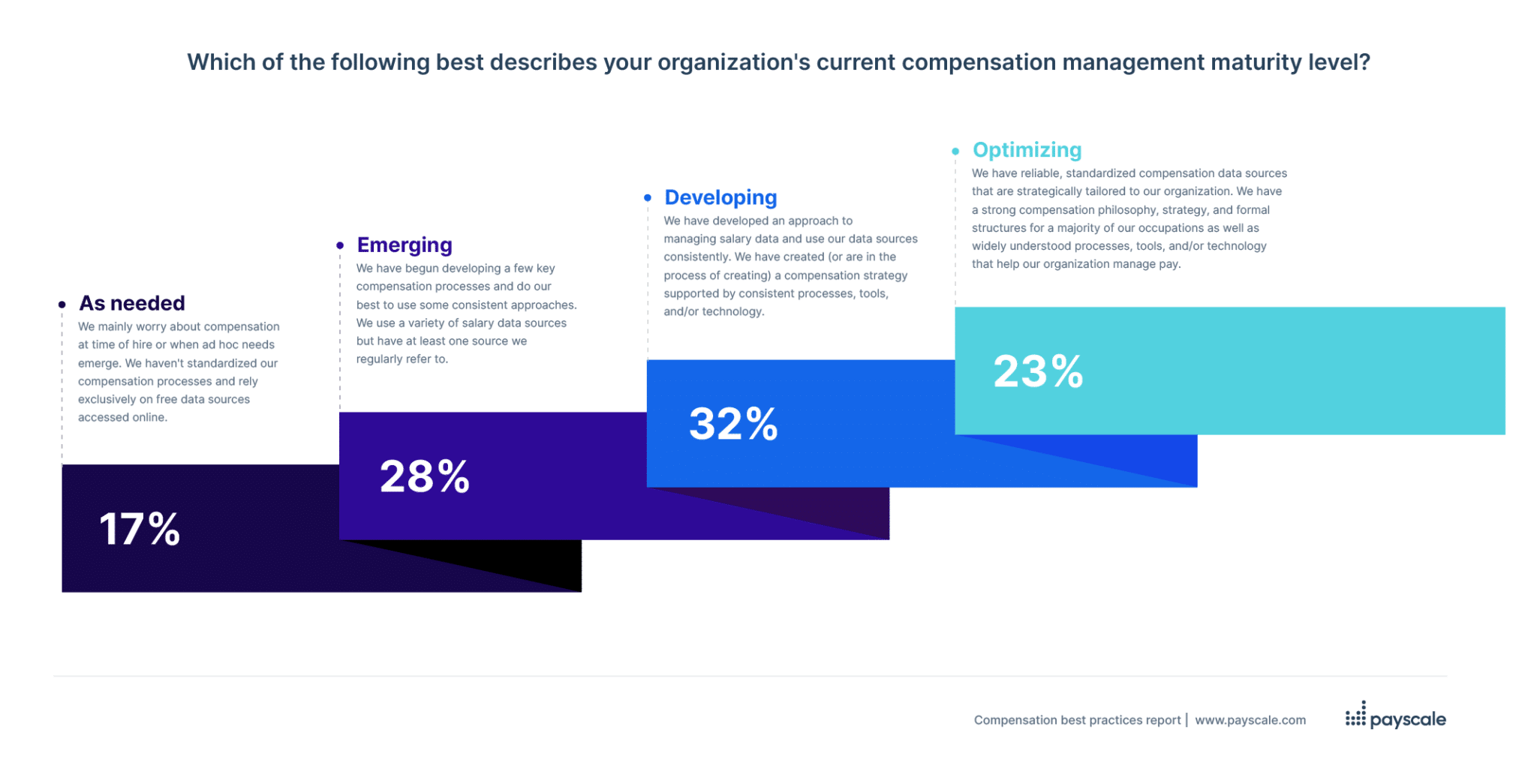

A compensation maturity model is a useful tool for measuring the current state of your compensation program. It can also help in communicating with your executive team and business partners about your progress toward established goals, either compared to competitors or against the broader market.

In our survey, we asked participants to rate themselves according to Payscale’s 2024 compensation maturity model. Just over half (55 percent) are in either the Developing or Optimizing stages while 45 percent are in a less mature state. Larger organizations are more likely to be in more advanced stages of compensation maturity than smaller organizations.

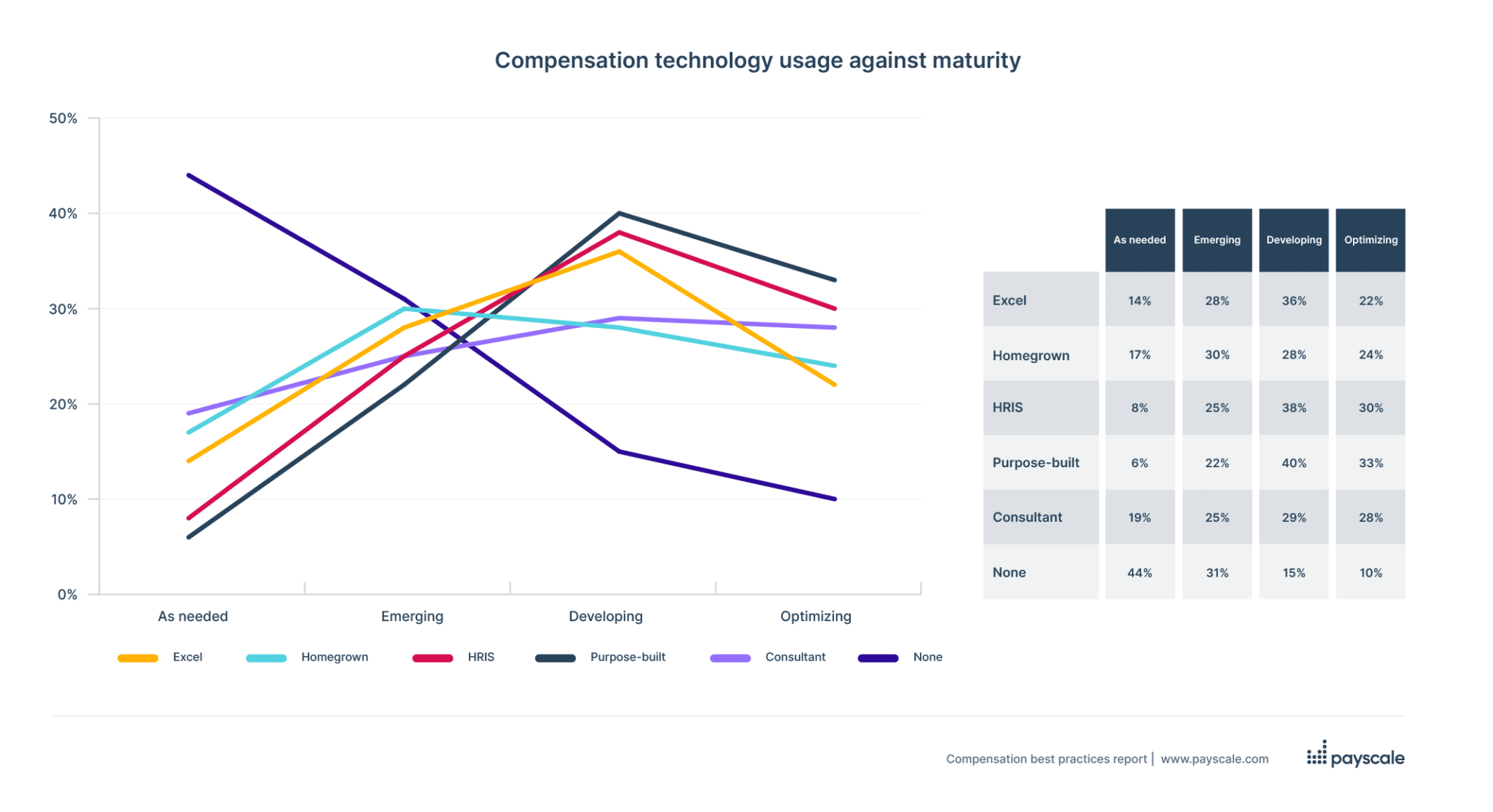

We also see a relationship between compensation maturity and compensation technology, with the strongest link seen between using purpose-built compensation software like Payscale and both the Developing and the Optimizing stages of the compensation maturity model. Using purpose-built compensation software empowers organizations to automate workflows and focus on the strategic outcomes of compensation management.

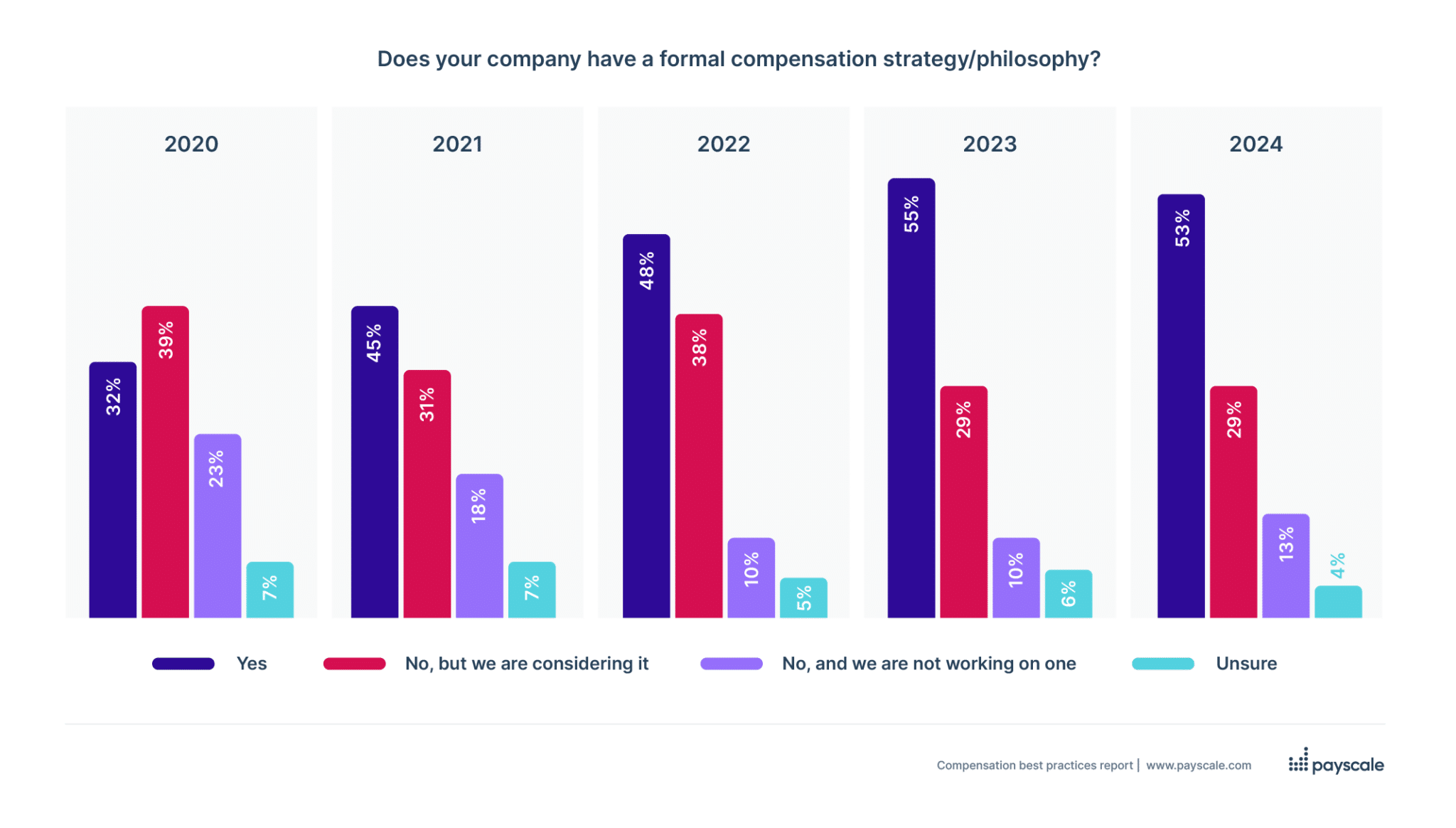

Compensation strategy

Since the pandemic, more organizations are investing in compensation strategy. While there has been little change since 2023, the percentage of organizations that have a compensation strategy has risen from less than a third to a majority in only a handful of years. Compensation strategy is essential for aligning with business changes and needs, including building equitable pay structures on the journey to pay transparency.

Part of compensation strategy is the development and maintenance of formal pay structures. According to our survey, traditional pay grades continue to be the most popular type of pay structure. However, market-based pay ranges — both job-based and grade-based — are rising in popularity when considering both current and future target states.

Salary data

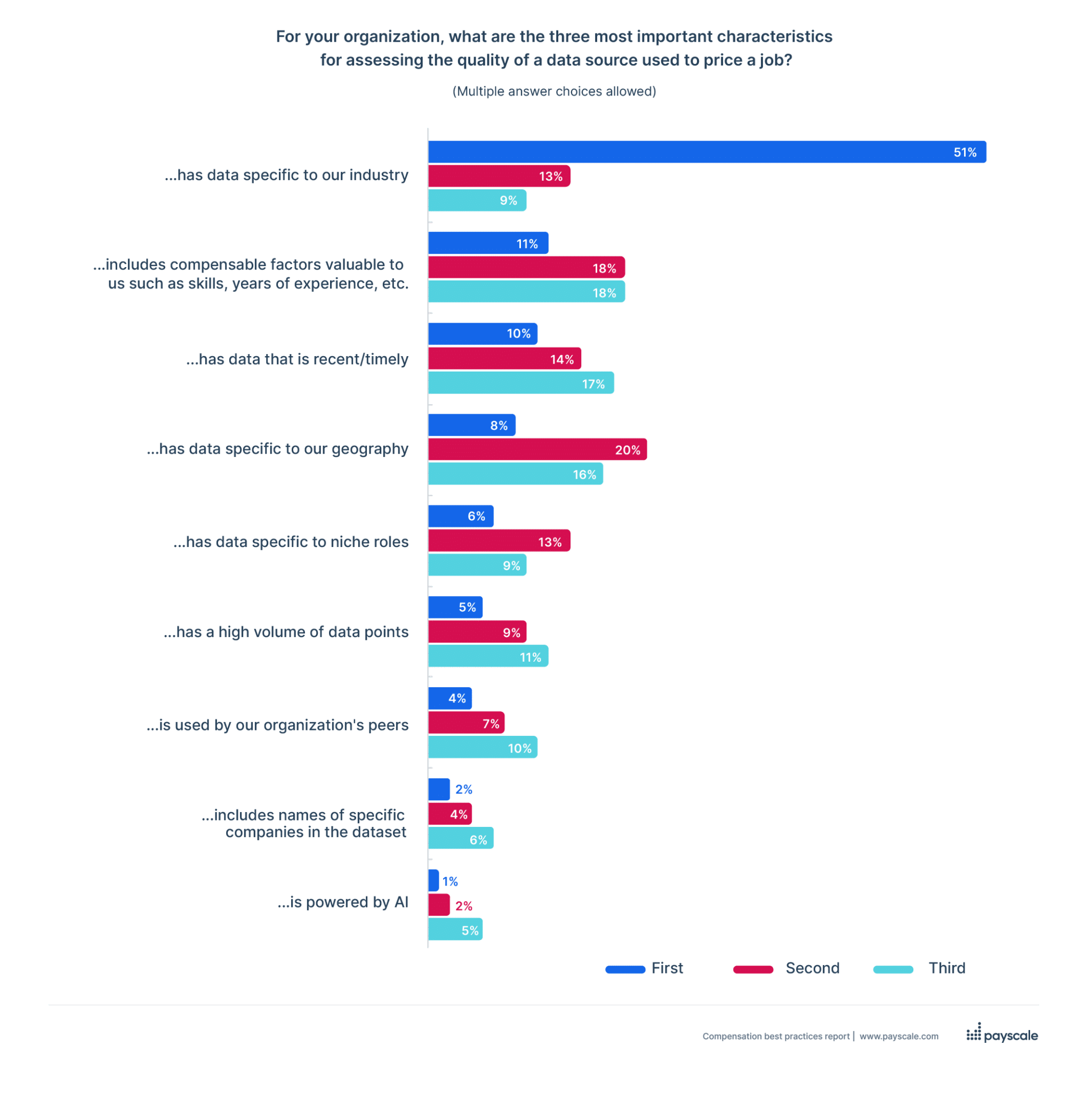

A majority of organizations (56 percent) use at least two to four unique sources of market data, with 63 percent using two to four sources to price specific jobs. According to our survey, the most important characteristic of assessing the quality of a data source is that it is specific to the industry, followed by the inclusion of compensable factors, the timeliness of the data, and being specific to geography. Being powered by AI was the least consequential factor in assessing quality.

Payscale provides multiple sources of salary data in one platform — such as HR-reported aggregate market data (HRMA), Peer, and employee-reported data (ERD) — alongside traditional salary surveys so that organizations have all the data sources they need to market price jobs and analyze fair pay all in one place.

Artificial intelligence

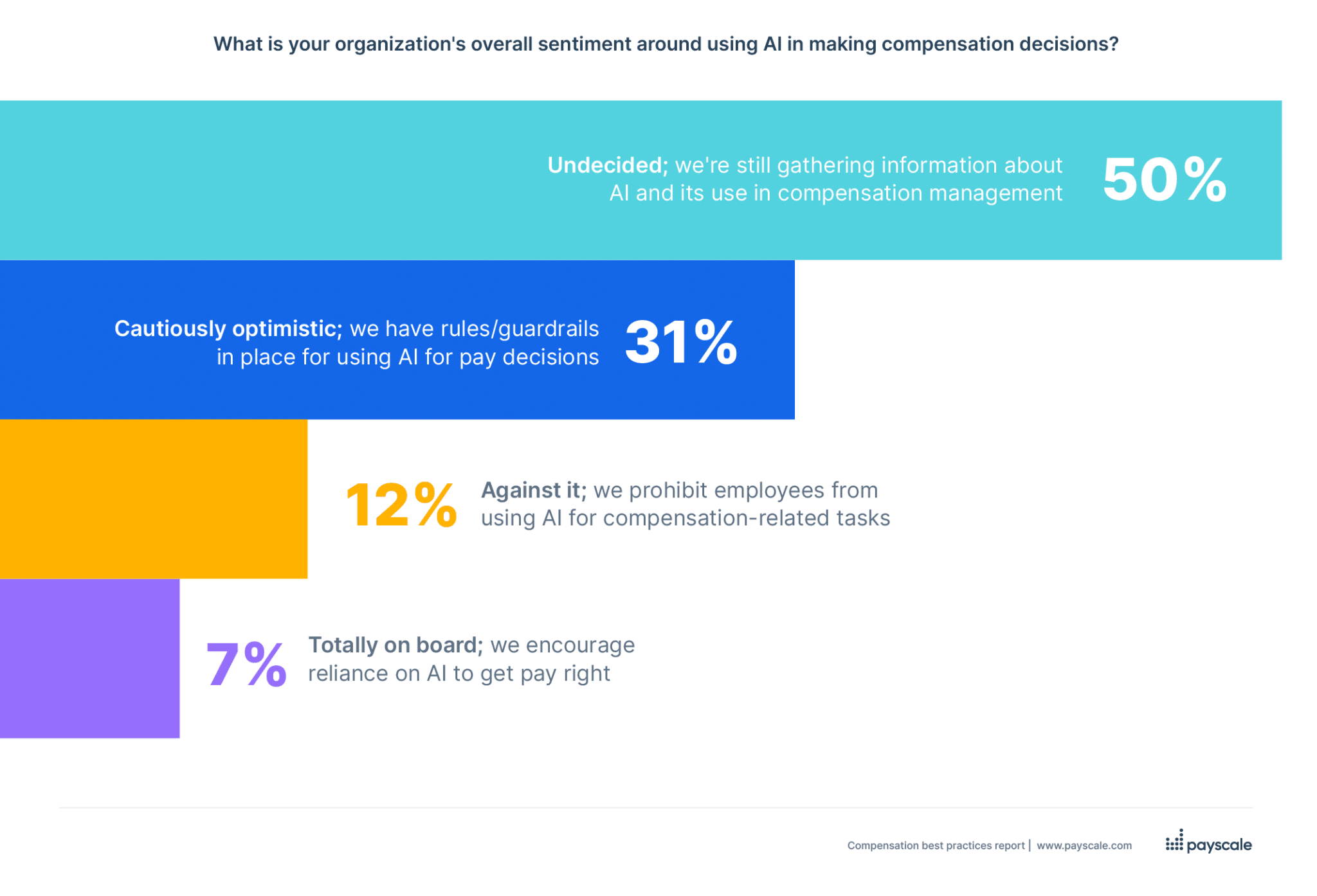

While its use is the least consequential factor in assessing the quality of salary survey data, artificial intelligence in some form has been a feature of compensation management for many years. However, given that 50 percent of organizations are undecided about the use of AI in compensation management, more can be done to educate HR leaders and compensation professionals in how AI is being used currently to make pay decisions as well as its future potential.

HR leaders and compensation professionals feel largely positive when it comes to artificial intelligence generally. While still a slight minority, 49 percent of respondents said they are optimistic about it while 34 percent said they are unsure, and only 17 percent are pessimistic. Out of respondents who are optimistic, the leading reason is that AI may reduce unfulfilling work. Out of respondents who are pessimistic, the leading reason is that AI may extend bias.

Methodology

The 2024 Compensation Best Practices survey gathered 5,735 responses from November–December 2023 with a completion rate of 55 percent. A breakdown by organization size, industry, and other firmographics are available in the methodology at the end of the full report.

Top Performers

Top-performing organizations are defined as those who exceeded their revenue goals in 2023. In this year’s study, 21 percent of respondents fit this criterion, which is below last year’s (25 percent).

Organization Size

We separate out six organizational sizes for comparison. About 30 percent of respondents represent organizations with fewer than 100 employees; 29 percent of respondents represent mid-sized organizations with between 100 and 749 employees; 21 percent of respondents represent organizations with between 750 and 4,999 employees; 7 percent represent organizations with between 5,000 and 9,999 employees, 8 percent represent organizations with 10,000 to 49,999 employees, and 4 percent represent organizations with more than 50,000 employees.

Industry

Our report provides response data for organizations in 16 industries. As in prior years, the top industries represented in the survey were Healthcare & Social Assistance (12 percent), Manufacturing (11 percent), Technology (including software) (10 percent), and Finance & Insurance (9 percent).

Location

Respondents to this year’s survey were predominantly in the United States (82 percent), with 11 percent in Canada and the rest from other countries, with no other country representing more than one percent.

Job Level

Respondents were a mix of job levels this year. Managers or directors made up half of respondents at 50 percent combined. Executives made up 21 percent of respondents with VPs and C-suite positions combined. Individual contributors made up 29 percent of respondents.

Roles

Our respondents play a variety of roles in the compensation process, including reviewing and making pay-increase recommendations (58 percent), completing comp market studies (45 percent), creating or managing job descriptions (63 percent), selecting data sources (50 percent), using compensation software to manage pay (32 percent), and more.

Labor Market Data

Data on job openings, hires, and separations comes from the Job and Labor Turnover Survey, December 2023 release, from the Bureau of Labor Statistics (BLS). https://www.bls.gov/jlt/